Managing money has become easier than ever, thanks to the latest fintech apps that cater to various financial needs. According to a report by Statista, the Indian fintech market is expected to reach $150 billion by 2025, highlighting the growing adoption of financial technology in the country. Whether you’re looking to budget, invest, or simply keep track of your expenses, these tools have you covered. Let’s dive into some of the top apps that are making waves in India.

1. Walnut

Founded In: 2014

Top Features: Expense tracking, bill reminders, split expenses, and money management.

What People Like:

- Easy-to-use interface.

- Automatic expense tracking via SMS.

- Insights into spending patterns.

What People Don’t Like:

- Limited investment features.

- Occasional syncing issues with bank accounts.

Cost: Free with in-app purchases.

Rating: ★★★★☆

About Walnut: Walnut is a popular money management app that tracks your expenses automatically by reading your SMS messages. It gives you a clear picture of where your money is going and helps you set budgets for different categories. The bill reminder feature ensures you never miss a payment. However, if you’re looking for advanced investment tools, you might find Walnut a bit limited.

2. ETMONEY

Founded In: 2015

Top Features: Mutual fund investments, insurance, expense tracking, and instant loans.

What People Like:

- Wide range of investment options.

- User-friendly interface.

- Tax-saving investment plans.

What People Don’t Like:

- Customer support could be better.

- Some users report bugs in the app.

Cost: Free with in-app purchases.

Rating: ★★★★☆

About ETMONEY: ETMONEY is a comprehensive personal finance app that allows you to manage your investments, track expenses, and even get insurance. It's particularly popular for its mutual fund investment options, which are easy to navigate even for beginners. The app’s tax-saving options are a big plus, especially for salaried individuals. However, some users have noted occasional bugs and glitches.

3. Groww

Founded In: 2016

Top Features: Stock and mutual fund investments, digital gold, and SIPs.

What People Like:

- Simple and intuitive interface.

- Low fees for stock trading.

- Quick account setup.

What People Don’t Like:

- Limited features for advanced traders.

- No margin trading options.

Cost: Free with trading fees.

Rating: ★★★★☆

About Groww: Groww is a great app for those who want to start investing in stocks and mutual funds. The app is designed to be user-friendly, making it ideal for beginners. It also offers the option to invest in digital gold and start SIPs with minimal hassle. While it’s fantastic for new investors, advanced traders might find it lacking in terms of features like margin trading.

If you want to learn how to make the most of your money and learn some smart budgeting hacks, you can click here to read my blog on the same.4. CRED

Founded In: 2018

Top Features: Credit card payment rewards, credit score monitoring, and bill tracking.

What People Like:

- Rewards for timely credit card payments.

- Credit score monitoring and tips.

- Slick and stylish interface.

What People Don’t Like:

- Limited to credit card users.

- Requires a high credit score to join.

Cost: Free

Rating: ★★★★☆

About CRED: CRED is more than just a credit card payment app; it's a lifestyle app that rewards you for making timely payments. The more you pay your bills on time, the more rewards you earn. It also offers a detailed view of your credit score and provides tips to improve it. However, it’s only available to users with a high credit score, which can be a downside for some.

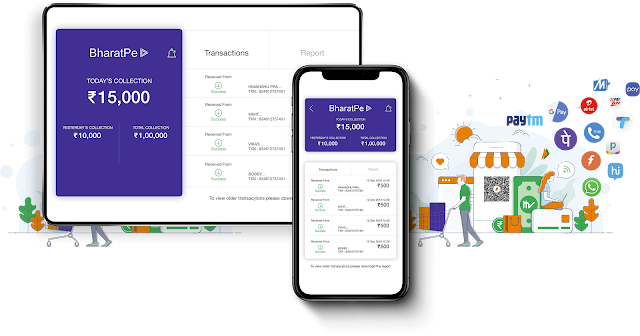

5. BharatPe

Founded In: 2018

Top Features: Payment acceptance, merchant loans, and QR code payments.

What People Like:

- No transaction fees for merchants.

- Instant settlement of funds.

- Merchant loans with quick approval.

What People Don’t Like:

- Limited features for personal users.

- Customer service can be slow.

Cost: Free

Rating: ★★★★☆

About BharatPe: BharatPe is a fintech app designed specifically for small and medium-sized businesses. It allows merchants to accept payments via QR codes without any transaction fees, which is a huge advantage. The app also offers instant merchant loans with minimal paperwork. While it’s an excellent tool for business owners, it might not be as useful for personal finance management.

6. Paytm Money

Founded In: 2017

Top Features: Mutual fund investments, stock trading, and digital gold.

What People Like:

- Easy integration with Paytm wallet.

- Low brokerage fees.

- User-friendly interface for investments.

What People Don’t Like:

- Limited research tools for stock traders.

- Some users report delays in fund transfers.

Cost: Free with trading fees.

Rating: ★★★★☆

About Paytm Money: Paytm Money is a one-stop shop for your investment needs, allowing you to invest in mutual funds, stocks, and even digital gold. The app seamlessly integrates with the Paytm ecosystem, making transactions quick and easy. It’s particularly well-suited for users who are already familiar with Paytm. However, advanced traders might find the research tools a bit lacking.

7. Zerodha

Founded In: 2010

Top Features: Stock trading, mutual funds, commodities, and direct mutual funds.

What People Like:

- Lowest brokerage fees in the industry.

- Advanced trading tools for professionals.

- Educational resources for investors.

What People Don’t Like:

- The interface can be overwhelming for beginners.

- No banking services are integrated.

Cost: Free with trading fees.

Rating: ★★★★☆

About Zerodha: Zerodha is a powerhouse when it comes to stock trading and investments in India. It’s known for having the lowest brokerage fees, which is a big draw for seasoned traders. The app also offers many educational resources, making it a great tool for learning about investments. However, the advanced features might feel a bit overwhelming if you're just starting out.

A survey by KPMG found that 67% of Indian consumers prefer using fintech apps for managing their finances, citing convenience and ease of use as the primary reasons. These fintech apps are revolutionizing the way people like us manage their money. Whether you’re looking to save, invest, or simply keep track of your spending, there’s an app out there to suit your needs. With the right tools at your fingertips, managing your finances can be both simple and effective. Happy budgeting and investing!

0 Comments